Hospital Cash Benefit provides cash per day of hospitalization.

Hospicash is necessary because it provides a fixed daily cash benefit during hospitalization, helping cover non-medical expenses like travel, food, and loss of income that regular health insurance may not pay for.

Multiple claims in a year uptothe Sum

Insured in Multiple Event Plan.

Benefit policy, is not dependent on the

actual hospital expenses.

24*7 coverage, anywhere in India cover

Includes both ICU and non ICUstay

No pre policy checkup required, unless

there is a pre-existing medical condition for Illness cover

Pays the insured over and above any other Health / Personal Accident policy

Coverage for any accident / sickness which needs more than 24 hours hospitalization

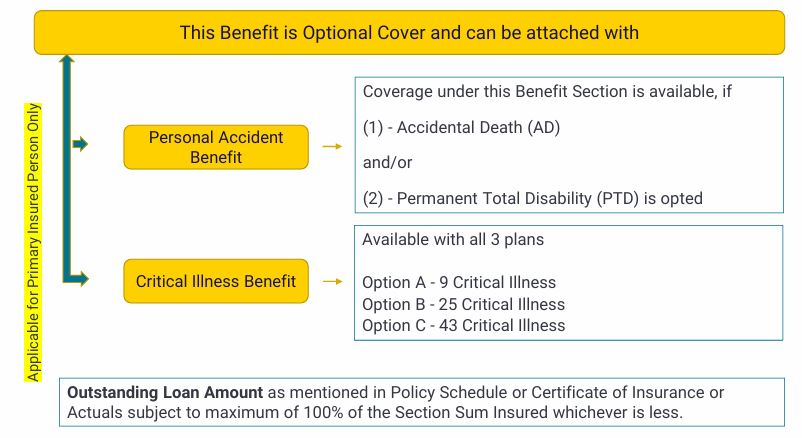

Personal Accident Insurance ensures financial protection after an accident.

Personal Accident Insurance provides financial protection by covering basic risks as a standalone plan and offering a benefit-based payout on the occurrence of an accident rather than on actual medical bills. It ensures independence in managing financial needs during unfortunate situations and works in addition to any existing health policy. The payout is flexible and can be used not only for medical costs but also for physiotherapy, caretaker support, rehabilitation, home or car modifications for mobility, loan repayments, or simply securing a financial balance for the future.

Basic Coverages

Accidental Death (AD) Only

Permanent Total Disability (PTD) Only

Permanent Partial Disability (PPD) Only

Temporary Total Disability (TTD) Only

Critical Illness Insurance secures you against major illness expenses.

Life is beautiful till the time we are not jolted by something unexpected. Critical Illness can be one of those many unexpected events which may disrupt all aspects of your life. Besides the emotional trauma that you may have to go through, your finances can also be shaken up. But remember,

whatever your diagnosis or emotional response, you are not powerless. Insure yourself and your loved ones under Critical Connect, a health insurance solution for you and your loved ones which would cover life threatening critical illnesses. A policy that would equip you to manage financial crisis in those difficult times.

Cancer of Specified Severity

End-Stage Liver Failure

Kidney Failure

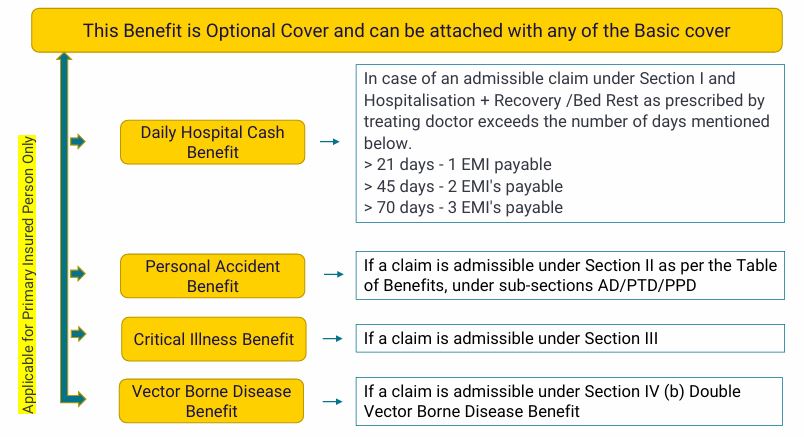

EMI Protector Benefit

The EMI Protector Benefit helps cover your loan EMIs in case of hospitalization, disability, or loss of income, ensuring your financial commitments continue without burden during difficult times.

Loan Protector Benefit

The Loan Protector Benefit secures your loans by covering repayments in case of disability, critical illness, or death, protecting your family from financial burden.

Provides financial security by covering outstanding loans when you cannot.

Keeps your assets and savings protected from loan repayment pressure.

Loan Protector Benefit ensures your loans are repaid in case of unforeseen events.

It safeguards your family from loan liabilities during illness, disability, or death.

Ensures peace of mind by securing loan EMIs against life’s uncertainties.